There are many reasons people decide to sell their home. You may need more space, be looking to downsize, need to relocate for work or to be closer to family, or have financial concerns. Whatever the reason, selling your home should be simple right? Someone wants your house, and you get paid to let them have it.

But there are many costs associated with listing your property for sale that many homeowners don’t really think about before diving into the excitement of the sale. In fact, selling your home can have some major costs connected with it that should be taken into consideration when deciding to list your home with an agent.

According to Bankrate.com, the commissions and fees consume up to 10 percent of the overall cost of the home. Of course, this does vary based on your location, price, and situation of selling. Let’s talk about the common costs home sellers find themselves shelling out for, both upfront and when the property closes.

Realtor Commissions

Having a real estate agent to guide you through the process of selling your home, but that expertise comes at a cost. The real estate commission is usually the biggest fee a seller pays — 5 percent to 6 percent of the sale price. If you sell your house for $250,000, for example, you could end up paying $15,000 in commissions. This total is split between your seller’s agent and the buyer’s agent – and in the vast majority of sales, the seller covers this cost, according to the National Association of Realtors. You won’t be required to pay this money upfront, as it will be subtracted from the total you receive at closing.

This fee can be negotiated with your individual agent, though by and large, most people pay this average. There are also flat-fee listings, but you receive significantly less support from the brokerage listing for this reduced price. Selling your home by yourself, known as FSBO, only accounted for around 10% of home sales in recent years.

Concessions

Sometimes, in order to actually make it to closing on your property, you may have to give back some of the money. These are called seller concessions. Seller concessions also help buyers who don’t have the cash on hand to cover all their closing costs. First-time home buyers often underestimate the costs associated with buying a home, so seller concessions are a way to help offset some of those costs and make the home more affordable. This can be preferable to having to wait longer for your buyer to secure closing funds or start the process with a new buyer. Depending on your buyer’s funding source (be it conventional, FHA, VA loans, etc), there are limits in place for how much concessions can be negotiated between buyer and seller.

Closing Costs

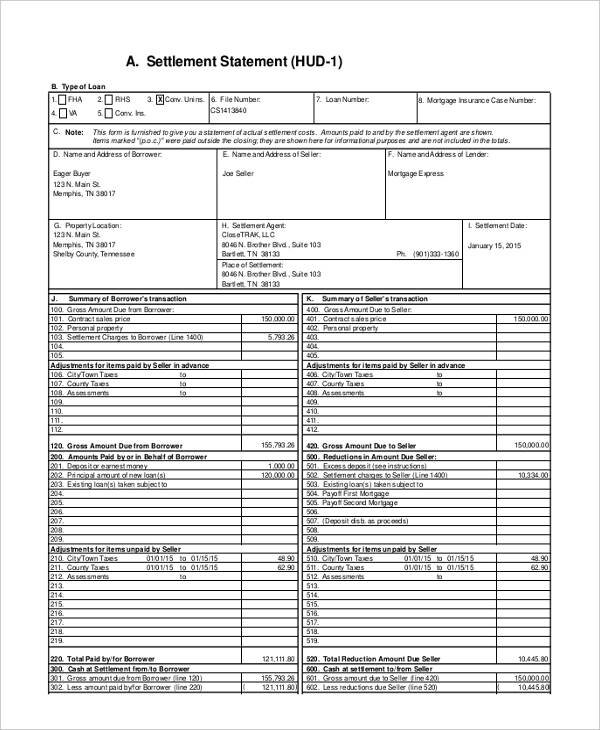

Closing costs are a collection of smaller expenses that are paid upon the closing of your home. You will see all of these listed on the settlement statement that your attorney goes over with you at closing, known as the HUD-1. These can include title search fees, title insurance, appraisal costs, recording fees, transfer fees, transfer taxes, and more. Closing costs typically run around 2% of your total sale price.

Taxes and Holding Costs

One of the many reasons people like to sell their homes quickly is because you are responsible for holding costs until the day of closing. Some examples of these costs are property taxes, utilities, homeowner’s insurance, and homeowner’s association fees. The amounts can add up to thousands of dollars if your home is not sold quickly enough. If you sell your home for significantly more than you purchased it for or if you are selling a property that is not your primary residence, you may be on the hook for “Capital Gains” taxes. You can find out more about capital gains on Bankrate.com.

Preparing Your Home for Sale

Before you even list your home, you may start racking up costs. Some repairs can be pricey, but necessary in order to attract buyers and ensure your home will qualify for funding; a new roof, foundation repairs, window replacement – all of these can cost a homeowner thousands of dollars. Cosmetic upgrades are less costly, but no less important. In order to attract buyers, your home may need sprucing up. A new coat of paint, updated lighting or plumbing fixtures, a deep cleaning of carpets… individually they may not break the bank, but they can add up.

Staging and storage – to truly attract today’s buyers, so many of whom dream of their own real-life HGTV moment, you may decide to work with a professional home stager. These pros come into your home, helping you declutter and redesign your space to make it as beautiful as possible. They may work with your own furniture, bring in their own items, or a mixture of the two. Whatever items that don’t make the stagers cut will need to be placed in storage until you move to your new home. The national average of staging costs is $1,600, but can be higher if you need to rent multiple rooms of furniture or if the time of your sale is extended.

Marketing

With so much of house hunting being done online these days, it is important to have good photographs to entice buyers to come and see your home. First impressions are important, so you don’t want dark photos of shadowy rooms. Many Realtors will encourage sellers to hire a professional photographer to shoot the photos and show off your home’s best features. They may even shoot a virtual tour video of your home. These photos will be the backbone of the marketing of your home. There are even drone photographers that can take trendy aerial shots of your home, property, and location – at a cost. A real estate photographer can be from $200 – $300 on average, with prices increasing for larger properties, further travel for the photographer, or complicated edits.

In Conclusion

Despite usually connecting selling something to be only connected with getting money, there are a wide variety of costs and fees associated with it. These can add up to take a big bite out of the profits on your home, and can even start costing you before the sale. If you are unsure about how all these costs will affect your bottom line, or would just rather not deal with shelling out for repairs, marketing, commission, and more, contact us today! There are never any fees for selling to us, and you’ll never have to clean, prep, or make any repairs. Fill out the form below or call us today for more information!